How to make copyright notes?

Reading time: 3 minutes

Written by: Cristina Peletti Leggi la bio for Canella Camaiora Studio Legale

In a law firm that deals with intellectual property, many clients ask how to make copyright notes. Here is the answer in a few paragraphs:

- How do you collect royalties for the assignment of copyright?

- Notes for authors over 35 years of age.

- Notes for authors under 35 years of age

- How are notes made for those residing abroad?

* * *

1.- How do you collect royalties for the assignment of copyright?

By ‘copyrights’ we mean the remuneration arising from the economic use of intellectual works, industrial patents and processes, formulas or information relating to industrial, commercial or scientific experience (e.g. royalties). But how do you make notes to collect these royalties? What exactly are we talking about?

For example, royalties relate to rights on the sale of books I have authored, software I have created, mobile phone apps, literary or artistic works, musical works, photographs, articles written for newspapers or magazines… the field is very wide indeed.

If they are received by the author or inventor and are not earned in the exercise of commercial enterprises, they are income equated to self-employment.

What does that mean? It means that I do not have to open a VAT number to receive remuneration for allowing the use of my works.

2.- Notes for authors over 35 years of age

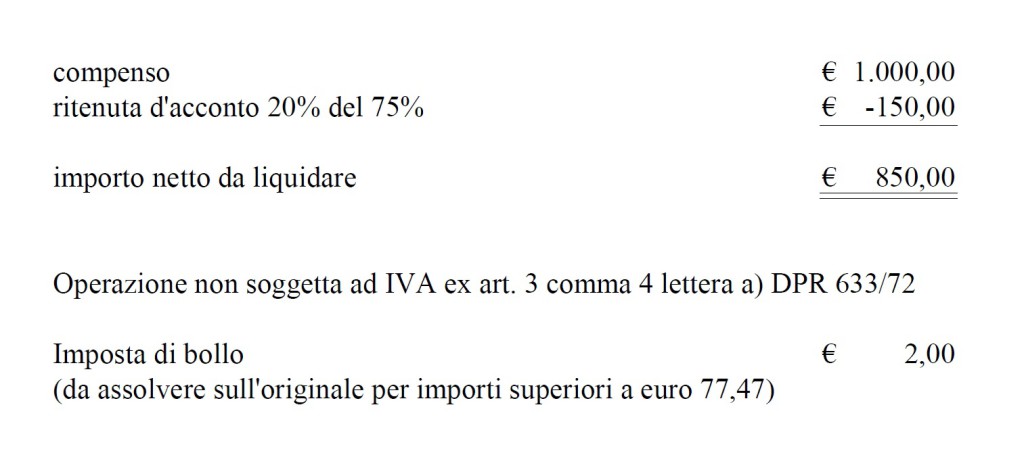

The fee is subject to withholding tax of 20% of the amount received reduced by 25%. The reduction of the taxable amount can be considered a flat-rate deduction of the costs incurred to produce the income.

Here the facsimile note-rights-author-sup-35

3.- notes for authors under 35 years of age

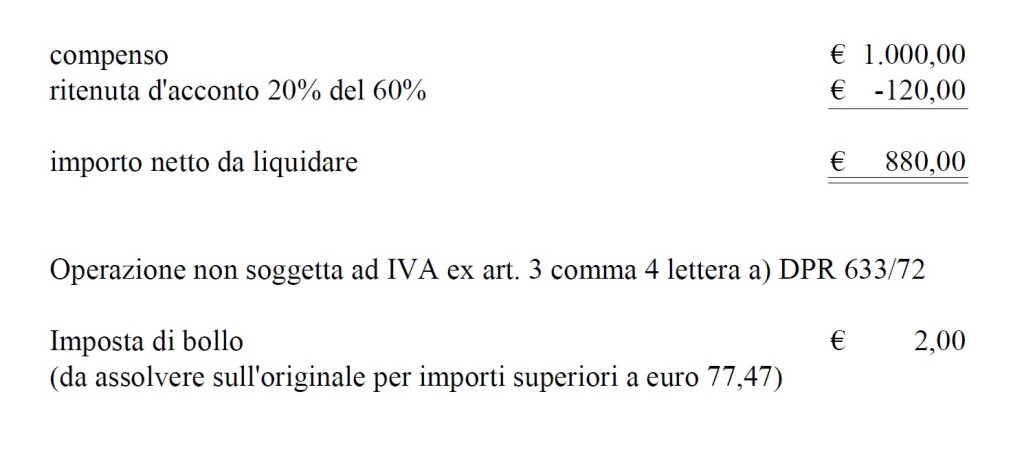

If the remuneration is received by a person under 35 years of age, the reduction in taxable income is 40%.

Here the facsimile note-rights-author-inf-35

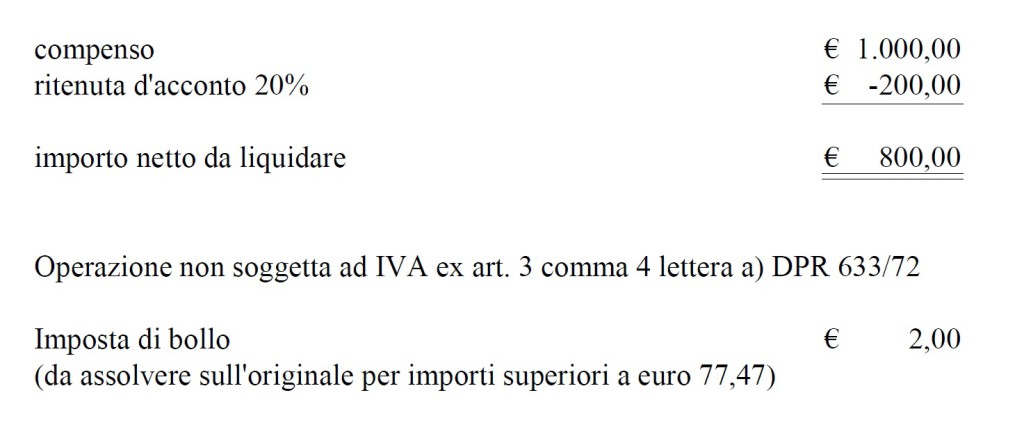

Notes for heirs or other assignees of rights

If it is not the author or inventor who receives the royalties but a third party who has acquired the rights from the author or has inherited them, the remuneration is no longer income considered as employment income but as a different income and the reduction in taxable income does not apply: the withholding tax is calculated on the entire amount received.

Here the facsimile note-rights-non-author

4.- Notes for those residing abroad

The cases set out above refer to notes for royalties of income recipients resident in Italy.

If, on the other hand, the recipient is resident abroad, the “basic rule” provides for a withholding tax of 30% of the remuneration received. International conventions may establish different percentages on a case-by-case basis. In such cases, it is necessary to apply for an exemption or reduction.

© Canella Camaiora S.t.A. S.r.l. - All rights reserved.

Publication date: 19 March 2022

Last update: 7 May 2025

Textual reproduction of the article is permitted, even for commercial purposes, within the limit of 15% of its entirety, provided that the source is clearly indicated. In the case of online reproduction, a link to the original article must be included. Unauthorised reproduction or paraphrasing without indication of source will be prosecuted.

Cristina Peletti